Expected rate of return formula

And 3 million respectively. The IRR formula is as follows.

:max_bytes(150000):strip_icc()/dotdash_Final_Inflation_Adjusted_Return_Nov_2020-01-c53e0ae26e8f404fb1ce91a9127cbd3b.jpg)

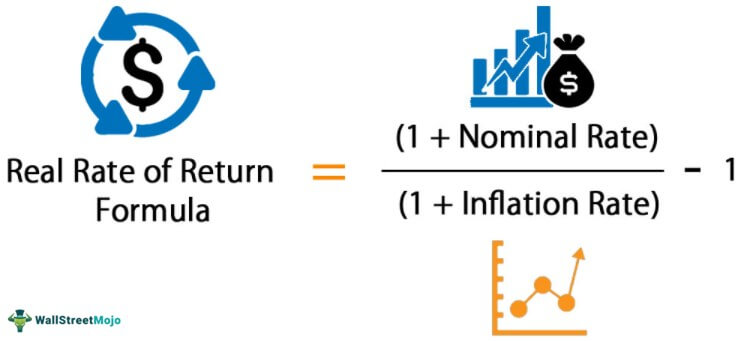

Inflation Adjusted Return Definition

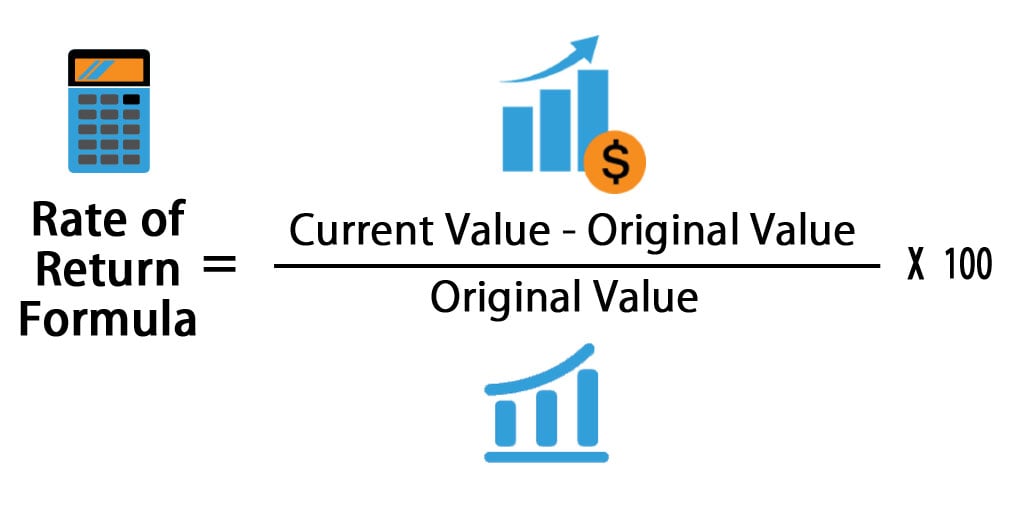

You can calculate this by ROR Current Investment Value Original Investment ValueOriginal Investment Value 100 read more.

. Gain A C1. Optionally you can put an expected internal rate of return say 10 percent in the guess argument. Heres another way to look at it.

After 3 years he sells the same asset for 150000. Pooled Internal Rate Of Return - PIRR. Follow these steps to calculate a stocks expected rate of return in Excel.

The complexity is linear in the returned value k which is λ on average. The formula for IRR is complex and so accountants usually use Excel. Conversely the effective interest rate can be seen as the true cost of borrowing from the point of view of a borrower.

Annualized Holding Period Return 47 1 13 1 Annualized Holding Period Return 1370 For Portfolio Y. Return on investment ROI or return on costs ROC is a ratio between net income over a period and investment costs resulting from an investment of some resources at a point in time. What is the Accounting Rate of Return.

Must contain at least 4 different symbols. The value is actually 15715. There are many.

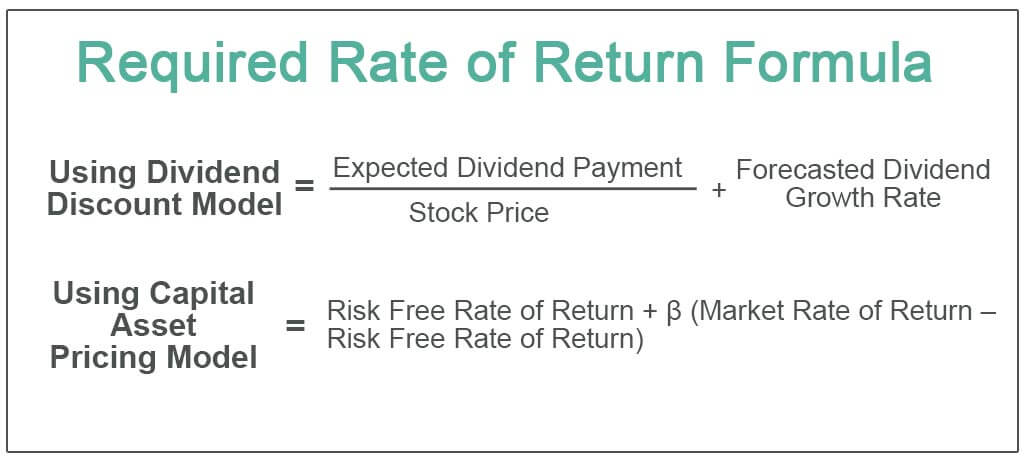

A rate of return is the gain or loss on an investment over a specified time period expressed as a percentage of the investments cost. IRRB2B8 10 As shown in the screenshot below our guess does not have any impact on the result. Here is the step by step approach for calculating Required Return.

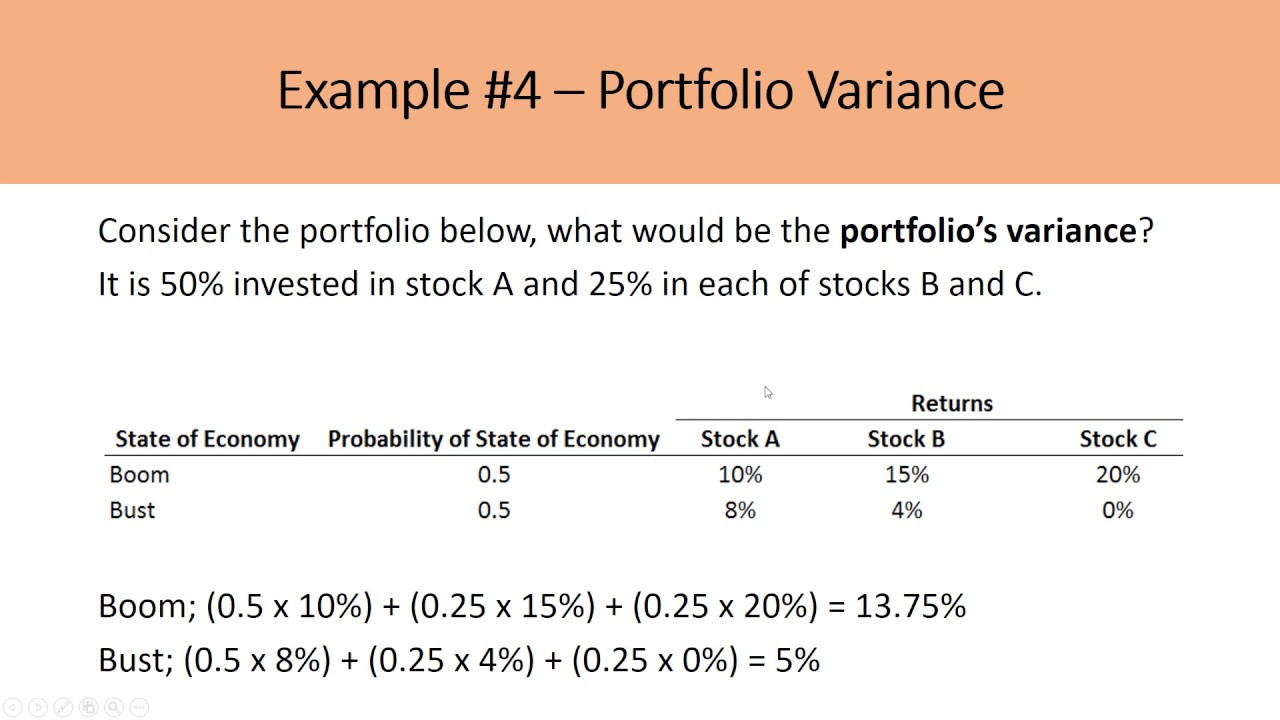

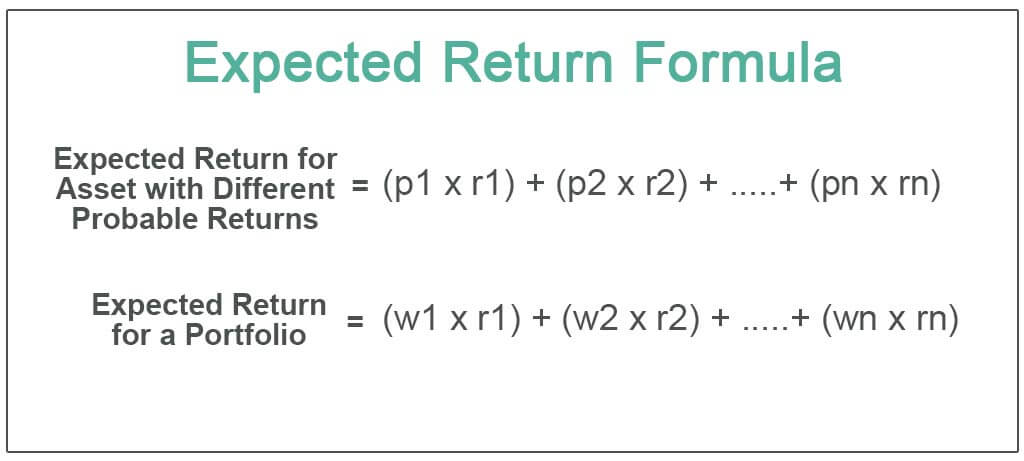

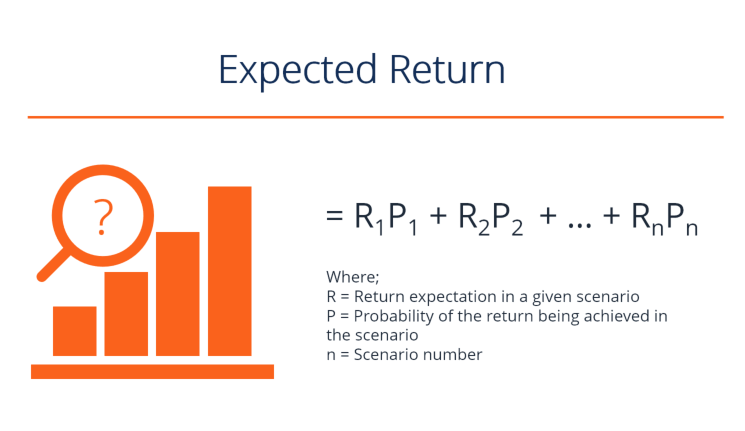

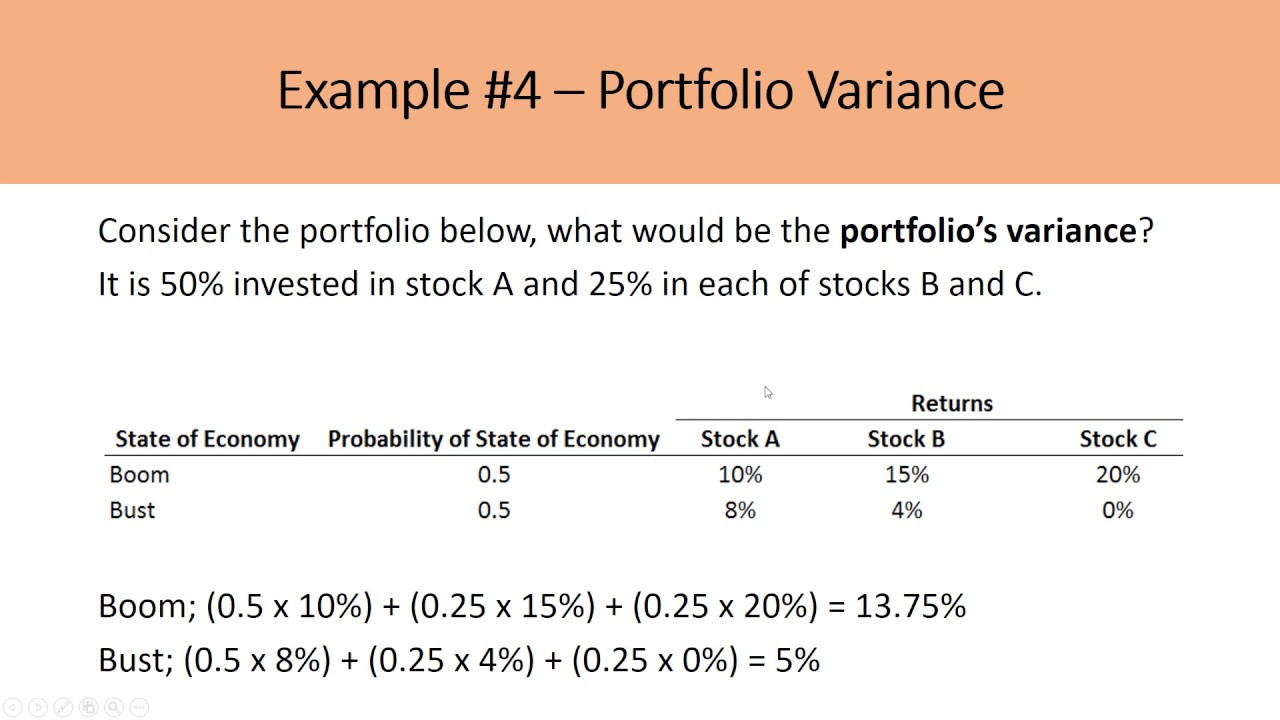

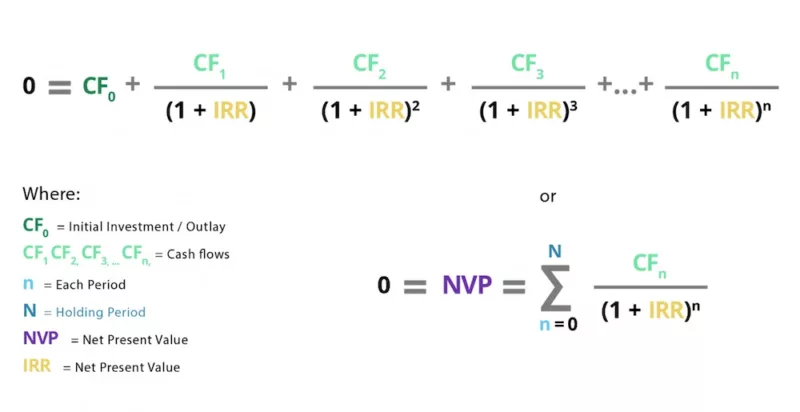

Expected Rate of Return Formula. 0 NPV P0 P11IRR P21IRR2 P31IRR3. Examples of Expected Return Formula With Excel Template Lets take an example to understand the calculation of the Expected Return formula in a better manner.

Annualized Holding Period Return 5692 1 15 1 Annualized Holding Period Return 943 Based on the given information Portfolio Y offers higher overall holding period return compared to Portfolio X. The capitalization rate often referred to as the cap rate is a fundamental concept used in the world of commercial real estate. Calculate Expected Rate of Return on a Stock in Excel.

The rate of return of the three securities is 85 50 and 65. It is the rate of return on a real estate. Given Total portfolio 3 million 4 million 3 million 10 million.

If you used your credit card with a 10 annual interest rate. Return k 1. For this set of cash flows we got the internal rate of return 16 using Excels IRR function.

While p L. But in some cases changing the guess value may cause an IRR formula to return a different rate. Practically any investments you take it at least carries a low risk so it is.

The formula for effective interest rate can be derived on the basis of the stated rate of interest and the number of compounding periods per year. R A 85. A high ROI means the investments gains compare favourably to its cost.

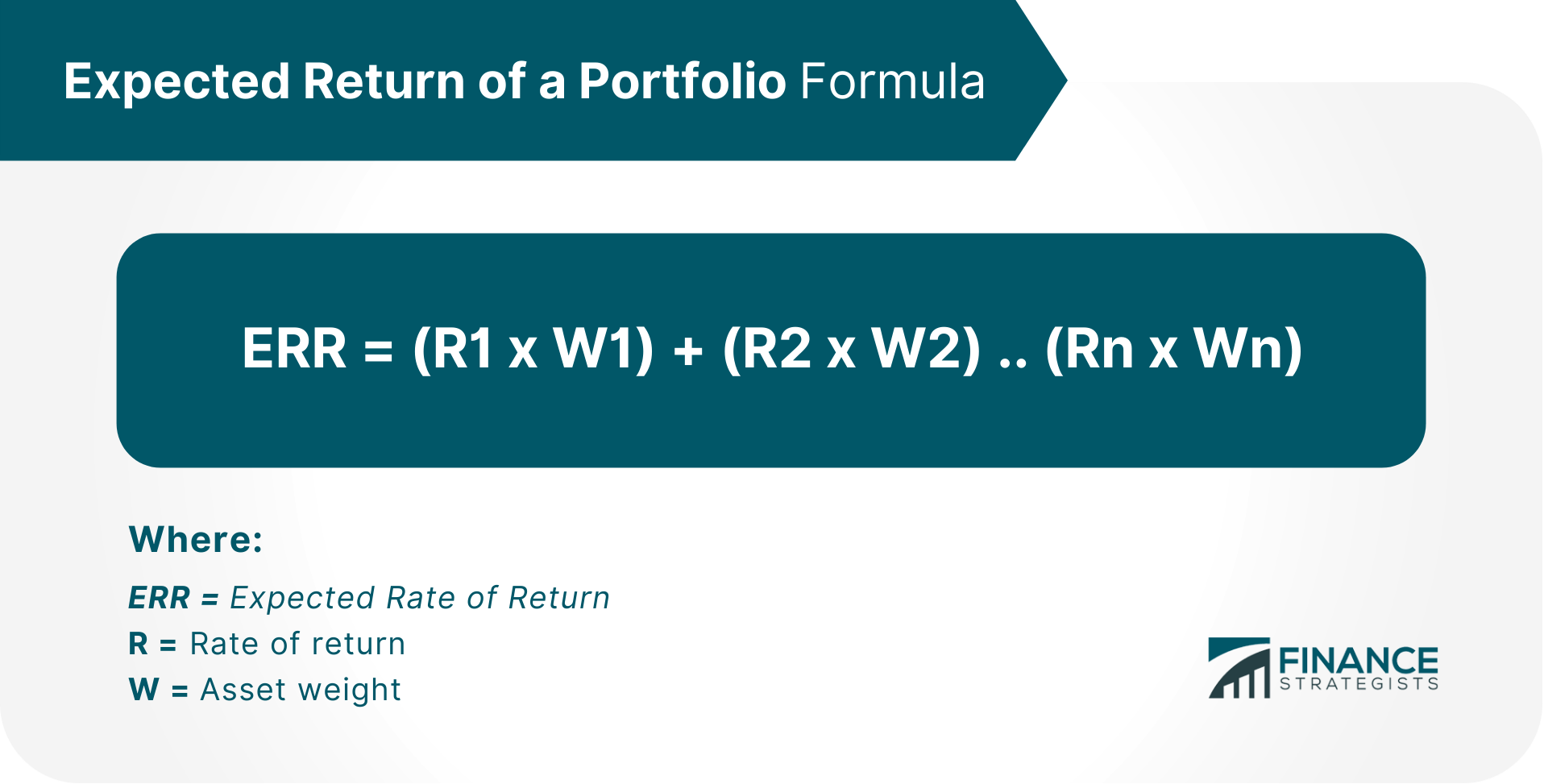

Gains on investments are defined as income. Rate of Return. The formula of expected return for an Investment with various probable returns can be calculated as a weighted average of all possible.

It is calculated by multiplying potential outcomes by. When the expected value of the Poisson distribution is 1 then Dobinskis formula says that the nth moment equals the number of partitions of a set of size n. For more information please see Multiple IRRs.

ASCII characters only characters found on a standard US keyboard. A simple bound is. Required Rate of Return 27 20000 0064.

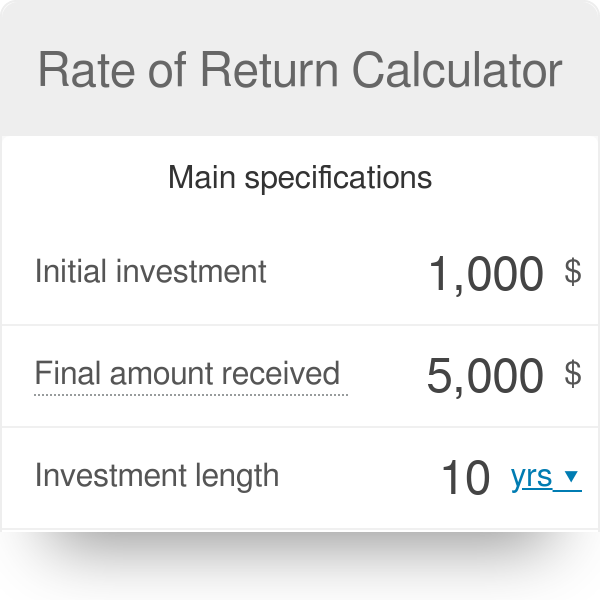

The expected rate of return can therefore be seen as a way of balancing out risks and potential rewards when making investment decisions. 6 to 30 characters long. Calculate Rate of Return Calculate Rate Of Return Rate of Return ROR refers to the expected return on investment gain or loss it is expressed as a percentage.

Lets take an example of a portfolio of stocks and bonds where stocks have a 50 weight and bonds have a weight of 50. Expected Return Formula Example 1. In the first row enter column labels.

Mr A decides to purchase an asset cost of 100000 which includes the relevant cost. Rate of Return Formula Example 3. Required Rate of Return 64 Explanation of Required Rate of Return Formula.

If you have already studied other capital budgeting methods net present value method internal rate of return method and payback method you may have noticed that all these methods focus on cash flowsBut accounting rate of return ARR method uses expected net operating income to be generated by the investment proposal rather than focusing on cash. All that is needed to calculate IRR in Excel is the initial investment amount and future cash yield per year. An investor purchase 100 shares at a price of 15 per share and he received a dividend of 2 per share every year and after 5.

It is also known as the effective annual return or the annual equivalent rate. Using the expected return formula above in this hypothetical example the expected rate of return is 71. Theoretically RFR is risk free return is the interest rate what an investor expects with zero Risk.

The companys cost of capital is more than the expected return from the proposed project or investment. Internal Rate of Return Formula. Expected return is the amount of profit or loss an investor anticipates on an investment that has various known or expected rates of return.

In this formula any gain made is included in formula. λ is the expected rate of occurrences. The overall IRR.

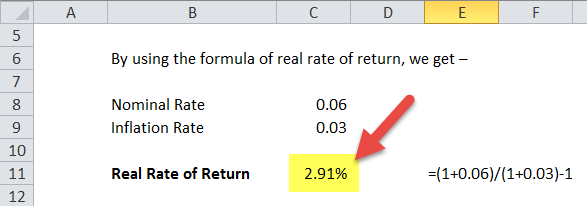

R C 6. As a performance measure ROI is used to evaluate the efficiency of an investment or to compare the efficiencies of several. The internal rate of return allows investments to be analyzed for profitability by calculating the expected growth rate of an investments returns and is expressed as a percentage.

The return of the Lafayette Art and Wine Festival over the weekend came after a pandemic delay and rain on Sunday kept some activities from taking place as planned. Accounting Rate of Return refers to the rate of return which is expected to be earned on the investment with respect to investments initial cost and is calculated by dividing the Average annual profit total profit over the investment period divided by number of years by the average annual profit where average annual profit is calculated by. Let us see an example to understand it.

If you use this Internal rate of return to calculate the present values of your future cash flows your initial investment will be balanced out I mean-1000 sum of future cash flows 0. Probability of Gain A. This formula is used by investors brokers and financial managers to estimate the reasonable expected rate of return of an investment given the risks of the investment and cost of capital.

R B 50. A method of calculating the overall internal rate of return IRR of a portfolio of several projects by combining their individual cashflows. Please calculate the rate.

/dotdash_Final_Calculating_the_Equity_Risk_Premium_Dec_2020-01-1ff6e59964b9408d9ac7d175f8ad1292.jpg)

Calculating The Equity Risk Premium

Rate Of Return Definition Formula How To Calculate

Required Rate Of Return Formula Step By Step Calculation

Expected Return Er Of A Portfolio Calculation Finance Strategists

Rate Of Return Formula Calculator Excel Template

:max_bytes(150000):strip_icc()/expectedreturncorrected-e0e026cf96334027b60d468d7fc59866.jpg)

Expected Return Definition

Real Rate Of Return Definition Formula How To Calculate

Rate Of Return Formula What Is Rate Of Return Formula Examples

Expected Return Formula Calculate Portfolio Expected Return Example

Expected Return How To Calculate A Portfolio S Expected Return

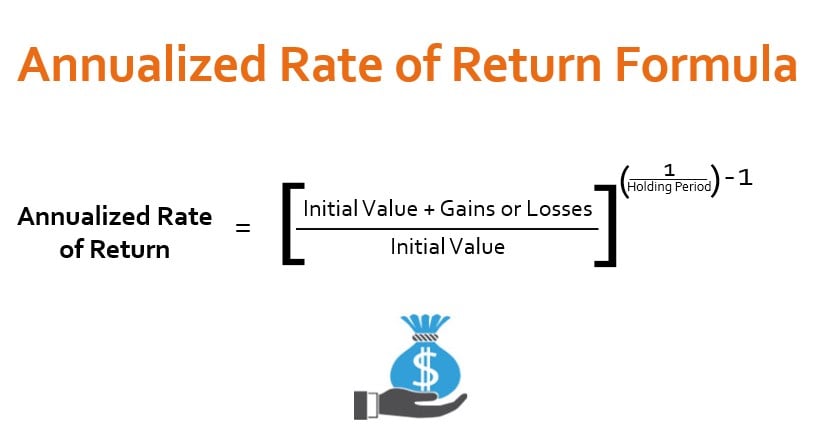

Annualized Rate Of Return Formula Calculator Example Excel Template

Real Rate Of Return Definition Formula How To Calculate

Rate Of Return Calculator

Real Rate Of Return Formula And Calculator

Calculating Expected Portfolio Returns And Portfolio Variances Youtube

/dotdash_Final_Inflation_Adjusted_Return_Nov_2020-01-c53e0ae26e8f404fb1ce91a9127cbd3b.jpg)

Inflation Adjusted Return Definition

Internal Rate Of Return Formula Definition Investinganswers